Some Known Details About The Maplewood Nursing Home Rochester Ny

Wiki Article

Little Known Facts About The Maplewood Nursing Home In Rochester Ny.

Table of ContentsAn Unbiased View of The Maplewood Nursing Homes Rochester NyThe Only Guide to The Maplewood Nursing Home Rochester NyLittle Known Facts About The Maplewood Nursing Home In Rochester Ny.Examine This Report about The Maplewood Nursing Home Rochester Ny

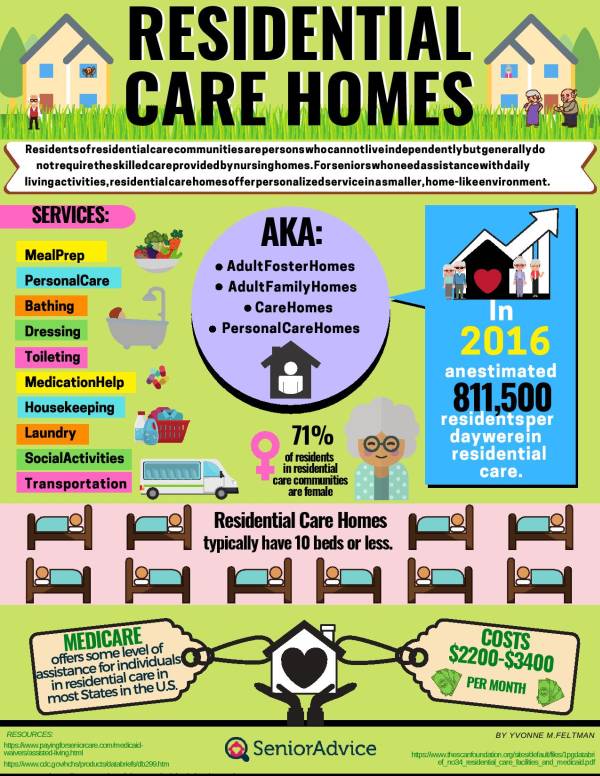

Properties are different than income. Numerous people pay for long-term care out of pocket till they "invest down" their possessions enough to be eligible for Medicaid.It will cover to 100 days of care in an assisted living home after a medical facility stay. Medicare pays the full cost of look after the very first 20 days. For days 21 to 100, you pay a $140 a day copayment. or can pay for long-term treatment in two ways: A or included protection, to a life insurance policy plan or annuity.

This arrangement enables you to obtain your fatality benefit while you're active if you're diagnosed with a serious illness. The business will deduct the amount you obtain for lasting care from the fatality benefit owed to your recipients when you pass away. Long-term care insurance coverage pays for numerous kinds of care, consisting of: Some policies pay for hospice treatment, respite treatment (treatment to enable pause for relative who are caretakers), care after a hospital remain, assist with house duties, or caretaker training for relative.

Plans usually do not cover: A pre-existing condition is an ailment you got clinical suggestions or therapy for in the six months prior to the day of coverage. Long-lasting treatment plans may delay coverage of a pre-existing condition for approximately six months after the policy's efficient date. Long-lasting care policies do not cover some mental as well as mental illness, however they need to cover schizophrenia, major depressive conditions, Alzheimer's illness, and also various other age-related problems.

The 15-Second Trick For The Maplewood Nursing Homes Rochester

You may need long-term treatment if persistent or major health problems run in your household. Ask yourself these inquiries: What are my assets? Will they transform over the next 10 this post to two decades? Are my possessions large sufficient to justify the price of a long-term treatment plan? What's my annual income? Will it alter over the following 10 to twenty years? Will I have the ability to afford the plan if my income drops or the premiums increase? Just how much does the plan cost? Exactly how a lot will the policy expense if I wait until I'm older to buy it? Long-lasting treatment premiums are normally less costly when you're younger.

The representative will certainly additionally tell you the firm's lasting treatment price increases over the past ten years. Although you can not utilize that to predict future price increases, it can give you a suggestion about exactly how much as well as how frequently rates have gone up for that firm. You may be able to subtract part of your lasting care costs from your tax obligations as a medical expense.

10 Easy Facts About The Maplewood Nursing Homes Rochester Described

You typically do not need to claim certified long-term care policy advantages as taxed income. If your policy is tax-qualified, it will certainly say so in your policy. Costs for non-tax-qualified long-lasting care policies aren't tax-deductible. You may also need to pay taxes on any type of advantages the plan pays that do not pay for care.Companies check out your health and wellness background to make a decision whether to offer you a policy as well as at what cost. More youthful individuals as well as those with couple of clinical concerns generally obtain reduced prices. A company could ask you to answer inquiries concerning your health or take a medical examination. Answer all questions honestly.

The majority of long-lasting treatment insurance coverage are specific plans. You buy individual policies straight from insurance coverage firms. Some groups supply lasting treatment policies to their members. Your employer may use a group long-lasting treatment policy to its workers - The Maplewood rochester ny nursing homes. Group plans rarely call for a medical exam. Some employers supply insurance coverage to retirees as well as member of the family.

Insurance provider need to allow you keep your coverage after you leave the group or until they terminate the team plan. You can proceed your protection or alter it to an additional long-term care insurance plan. Federal and U.S (The Maplewood nursing my response homes rochester). Post office staff members as well as senior citizens, active and also retired service members, as well as their dependents can get lasting treatment insurance with the Federal Long-Term Treatment Insurance Program.

The Buzz on The Maplewood Nursing Homes Rochester Ny

If you or a member of the family is a state or public staff member or retiree, you may be able to acquire lasting care insurance coverage under a state federal government program. In Texas, the Teacher Retirement System and also a number of university systems view it provide group plans. Some associations provide long-lasting care insurance coverage to their participants.You normally should have a medical examination to get an organization policy. Don't sign up with an association simply to purchase an insurance coverage. The organization may decide to quit providing the policy. The Long-Term Treatment Partnership is a collaboration in between exclusive insurance coverage companies, representatives, as well as the state of Texas. It helps Texans satisfy their lasting care needs.

Features include "dollar-for-dollar" asset protection, rising cost of living protection, and coverage that follows you to an additional state if you relocate. Dollar-for-dollar possession security suggests Medicaid will certainly ignore one dollar of your possessions for every single dollar your policy pays in benefits. This can assist you certify for Medicaid also if your assets are above the eligibility restrictions.

Report this wiki page